Addy AI

About Addy AI

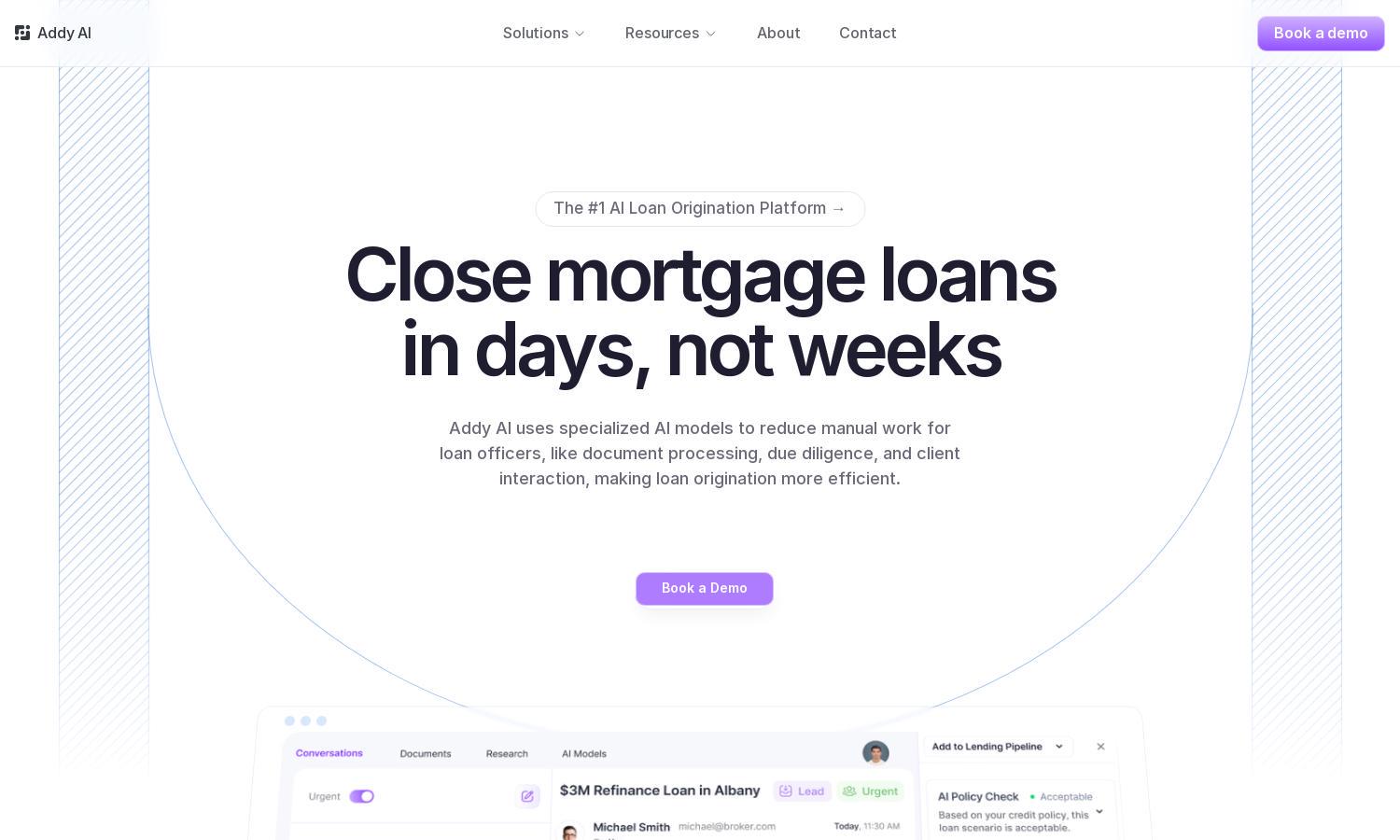

Addy AI is designed for mortgage lenders seeking efficiency in loan origination. By leveraging specialized AI models, it automates tasks such as document processing and client interactions, significantly reducing manual workload. This innovative platform allows lenders to close loans faster, enhancing user experience and satisfaction.

Addy AI offers flexible pricing plans tailored to different user needs, with options ranging from basic to advanced tiers. Each plan provides unique value, such as enhanced automation features and dedicated support. Upgrading allows users to benefit from quicker loan originations and improved efficiency, maximizing their investment.

The user interface of Addy AI is intuitively designed to promote seamless navigation and efficiency. With a clean layout and user-friendly features, it allows mortgage lenders to access essential tools and information promptly. This focus on design enhances the overall user experience, making loan origination streamlined and effective.

How Addy AI works

Users begin their journey with Addy AI by signing up and onboarding, where they can customize AI models tailored to their specific lending processes. Once set up, they navigate a streamlined dashboard that provides instant access to document processing, loan assessments, and CRM integration, making it easy to manage workflows and enhance efficiency.

Key Features for Addy AI

Custom AI Models for Automation

Addy AI's standout feature is its ability to train custom AI models that automate the loan origination process. This unique functionality allows mortgage lenders to enhance efficiency and reduce manual tasks, ultimately saving time and improving client satisfaction, making Addy AI a game-changer in the industry.

Instant Loan Assessments

Addy AI simplifies the loan evaluation process with instant assessments, automatically checking loans against credit policies. This feature not only speeds up decision-making but also provides actionable suggestions to improve borrower eligibility, ensuring a smoother and faster lending experience for users and clients alike.

Seamless CRM Integration

Addy AI's seamless CRM integration enhances workflow efficiency by automatically syncing and updating loan data. This feature allows mortgage lenders to manage their client interactions effectively, ensuring timely follow-ups and improved communication, which ultimately leads to higher borrower satisfaction and increased loan closure rates.

You may also like: