CPA Pilot

About CPA Pilot

CPA Pilot is a cutting-edge AI tax assistant designed for tax professionals seeking efficiency and accuracy. It provides instant access to authoritative resources and streamlined communication tools, enabling users to navigate complex tax codes and enhance client engagement. With exceptional accuracy, CPA Pilot redefines tax assistance.

CPA Pilot offers flexible pricing plans tailored to different needs. Users can choose from a Free Plan with 20 messages for a trial period, to a monthly subscription starting at $49 for 60 messages, or $99 for 150 messages per month. Upgrading ensures enhanced access and comprehensive features.

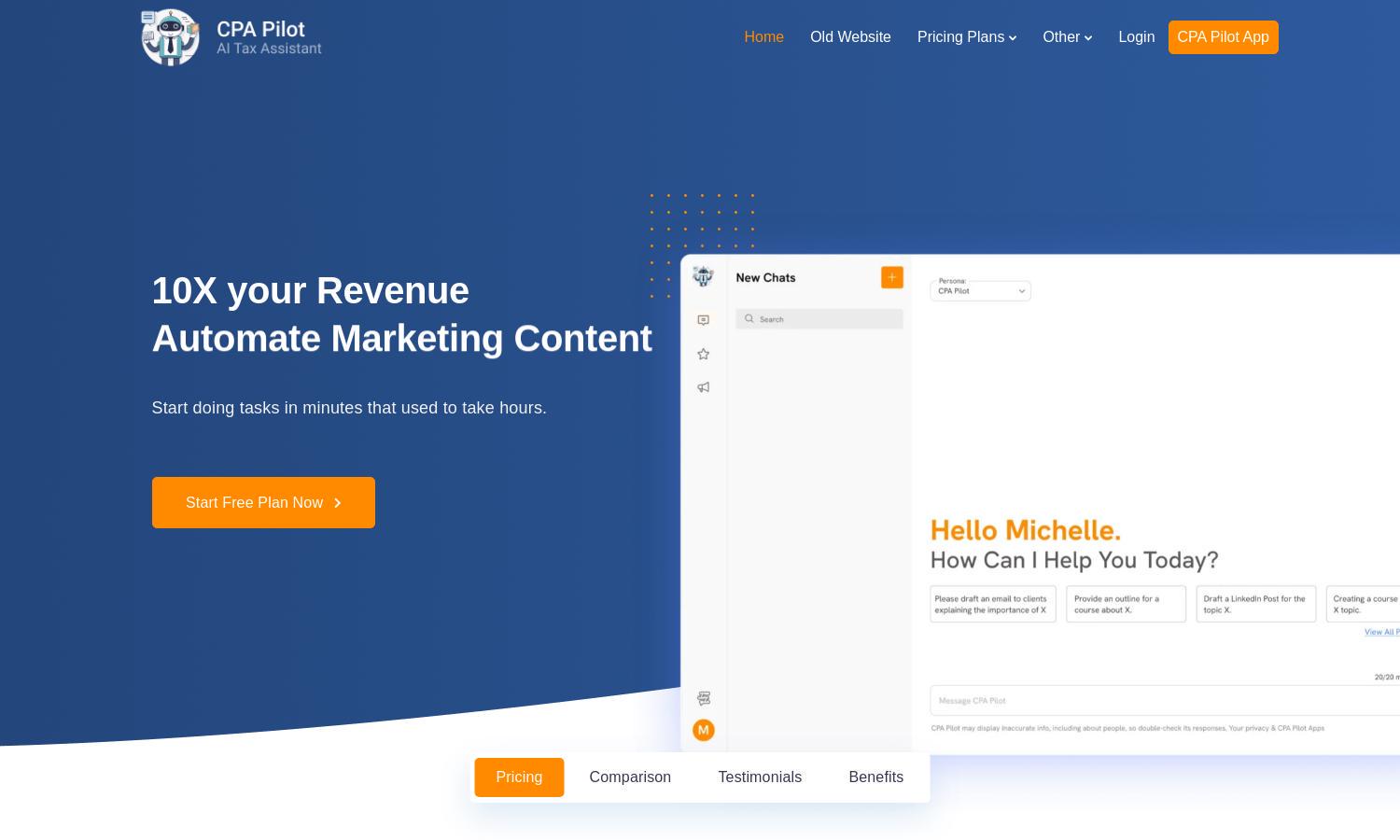

CPA Pilot’s user interface is designed for ease of use, featuring a clean and intuitive layout. It enables quick access to essential tools and resources, enhancing user experience. With organized sections for notifications, inquiries, and support, CPA Pilot ensures a seamless and productive browsing experience.

How CPA Pilot works

Users begin by signing up for CPA Pilot, where they can select a preferred plan. The user-friendly dashboard allows easy navigation through features like tax research, client communication, and marketing tools. Users simply input their queries or requests, receiving accurate, authoritative answers in less than a minute, streamlining their tax processes significantly.

Key Features for CPA Pilot

Instant Tax Research

CPA Pilot's Instant Tax Research feature delivers users prompt access to authoritative IRS resources and state tax codes. With quick and precise answers, CPA Pilot empowers tax professionals to navigate complexities effortlessly, enhancing their workflow and improving client service.

Automated Client Communication

Automated Client Communication in CPA Pilot facilitates efficient email drafting and response management. This feature allows tax professionals to expedite their client interactions, ensuring timely and clear communication that enhances client satisfaction while saving valuable time and effort.

Tailored Tax Strategy Generation

CPA Pilot excels in Tailored Tax Strategy Generation, enabling users to create personalized tax strategies that align with their clients' needs. This unique capability provides tax professionals with the tools to offer bespoke solutions, improving client outcomes and fostering stronger client relationships.

You may also like: