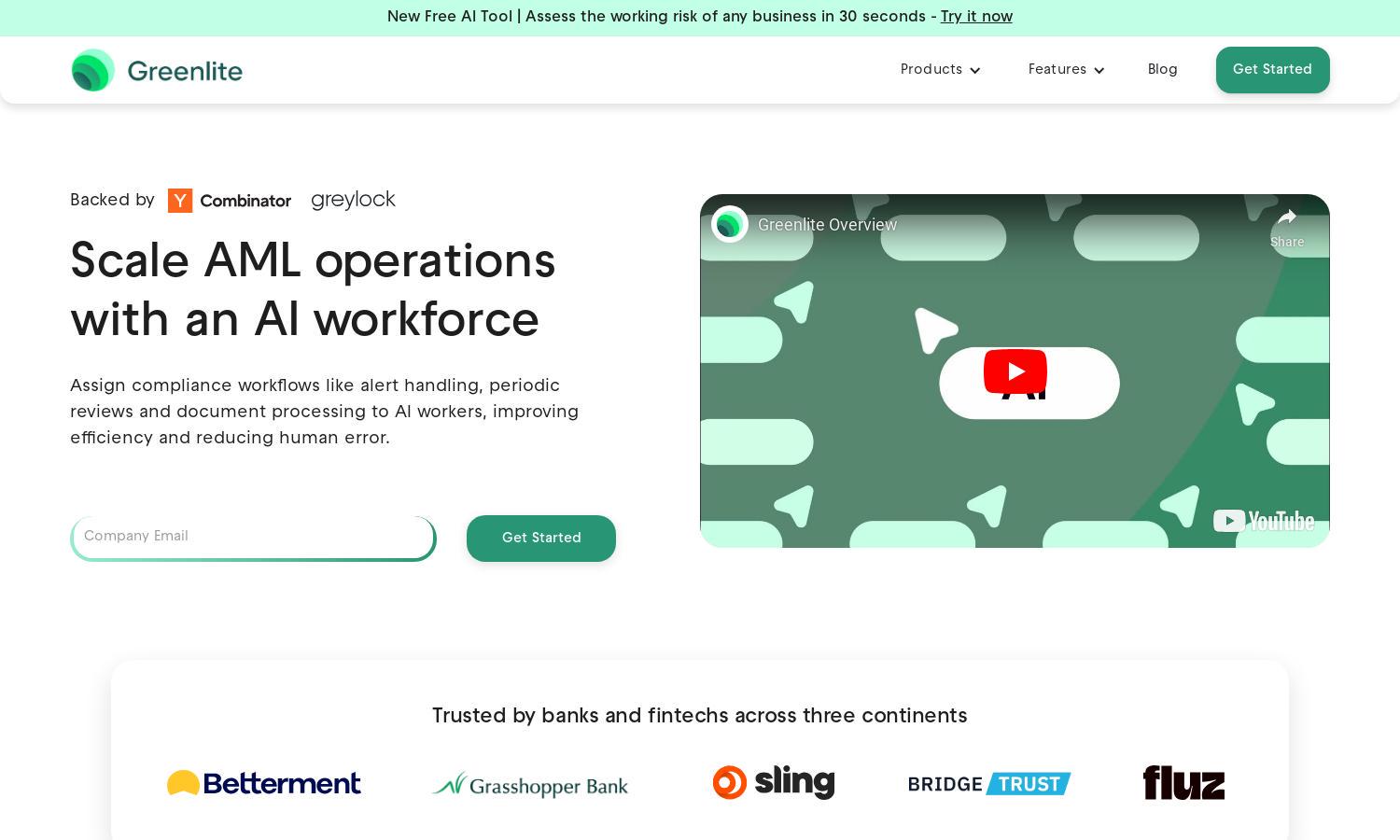

Greenlite

About Greenlite

Greenlite transforms financial crime compliance through AI, targeting banks and fintechs. By automating routine tasks such as AML reviews and transaction monitoring, the platform enhances operational efficiency, allowing compliance teams to focus on proactive risk mitigation and decision-making, ultimately bolstering regulatory adherence.

Greenlite offers a flexible pricing model tailored to various institutional needs, with subscription tiers designed for scaling operations efficiently. Each plan provides varying access to advanced AI features, with incentives for annual commitments. Upgrading facilitates improved compliance processes and substantial time savings for teams.

Greenlite’s user interface is designed for seamless navigation and efficiency. The layout prioritizes user experience, featuring intuitive dashboards and accessible workflows. Unique tools allow quick data integration and analysis, making it easy for compliance teams to leverage AI in their daily operations effortlessly.

How Greenlite works

Users interact with Greenlite by first onboarding their existing compliance processes into the platform. Key features are then easily accessed via an intuitive dashboard, allowing users to automate tasks like transaction monitoring and customer due diligence. By integrating with case management systems, Greenlite streamlines workflows, enabling compliance teams to focus on significant risks while improving their operational efficiency.

Key Features for Greenlite

Automated Screening Alerts

Greenlite's automated Screening Alerts revolutionize how compliance teams handle potential risks. By instantly investigating alerts from screening systems, it helps users efficiently clear false positives, significantly speeding up the review process and enhancing the overall compliance posture of institutions reliant on complex regulatory frameworks.

Comprehensive Transaction Monitoring

Greenlite offers comprehensive Transaction Monitoring capabilities, empowering compliance teams to analyze alerts with the thoroughness of seasoned analysts. By automating documentation and case details review, this feature accelerates the identification of genuine risks, ensuring swift and informed decision-making while maintaining high regulatory standards.

Enhanced Due Diligence Automation

Greenlite’s Enhanced Due Diligence feature automates high-risk customer reviews, providing thorough analyses with minimal manual effort. This unique capability not only speeds up the decision-making process but also ensures that compliance teams can scrutinize potentially dangerous business relationships more effectively, enhancing regulatory compliance.

You may also like: