Kick

Overview

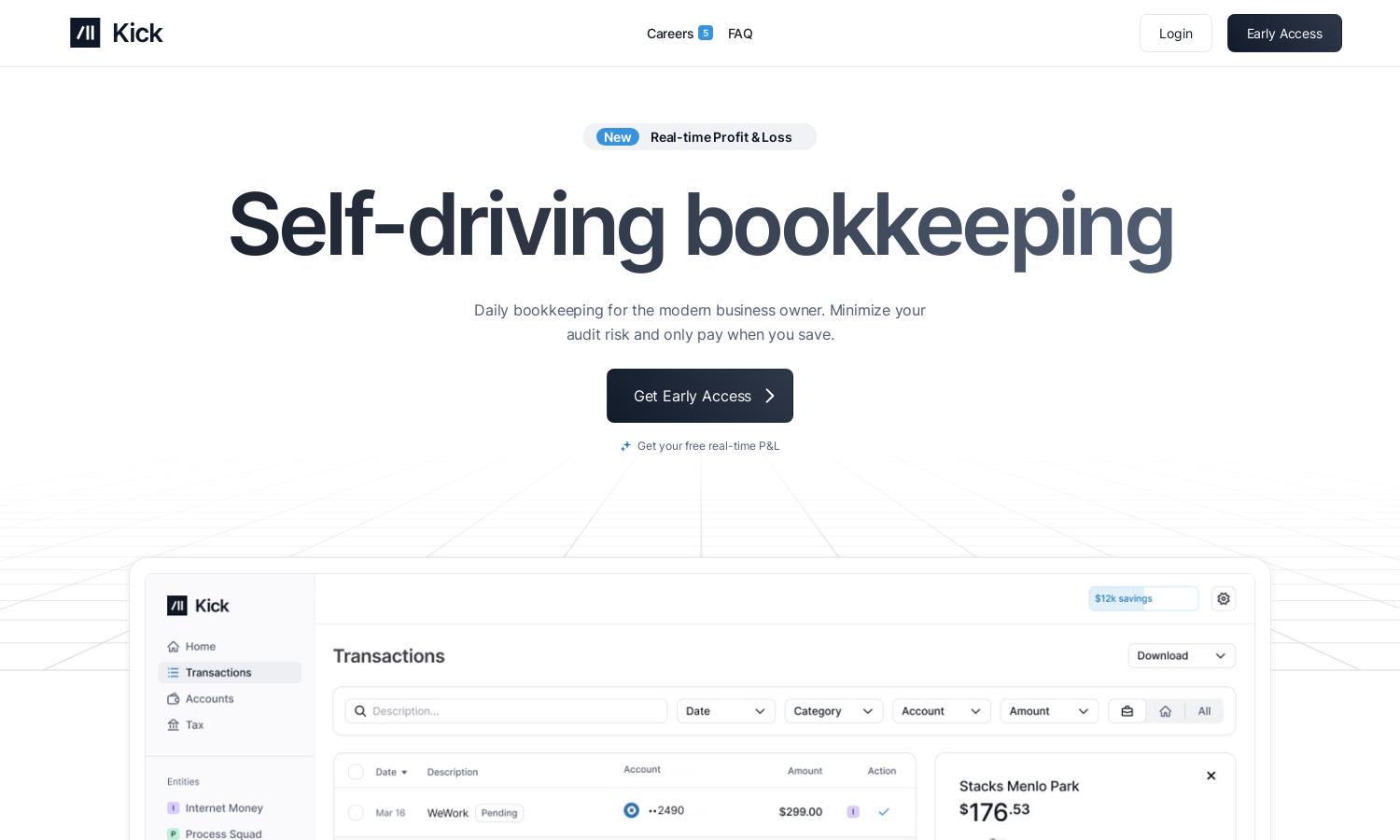

Kick is an innovative self-driving bookkeeping platform designed for modern business owners seeking to simplify their financial management. It primarily targets entrepreneurs and small to medium-sized enterprises, emphasizing efficiency and accuracy in bookkeeping tasks. The platform's standout feature is its real-time auto categorization of transactions, which is complemented by expert review to ensure precise financial records. This innovative approach not only alleviates the burden of manual bookkeeping but also helps users identify potential savings opportunities, ultimately driving profitability and fostering financial confidence.

Kick offers a flexible pricing structure based on a subscription model. Users can begin with an introductory plan that allows them to explore essential features, including real-time transaction categorization and receipt matching. Premium options provide advanced capabilities, such as deeper insights into spending habits and additional expert support, making it suitable for varied business sizes and needs. While specific pricing details may vary, promotions often include discounts for long-term subscriptions or enticing offers for new users, providing excellent value and encouraging upgrades to fully utilize the platform's capabilities.

Kick prioritizes user experience with a modern and intuitive interface that makes navigating the platform straightforward and enjoyable. The design is clean and user-friendly, allowing even those who are less tech-savvy to easily access their financial data and tools. Key functionalities are prominently placed, reducing the time needed to complete tasks. Features such as automatic updates and clear visual representations of financial health enhance usability, ensuring that users can effortlessly manage their bookkeeping while staying focused on their business objectives, distinguishing Kick from other accounting solutions in the market.

Q&A

What makes Kick unique?

Kick stands out with its self-driving bookkeeping service, which combines real-time auto categorization of transactions with expert oversight to ensure accuracy. It not only minimizes audit risks but also provides personalized insights, enabling business owners to focus more on growth rather than financial management. The service's ability to automatically match receipts and identify commonly missed deductions like home office expenses enhances its value, allowing users to maximize their savings effortlessly. With Kick, users can confidently monitor their financial health across multiple accounts and business entities at no additional cost.

How to get started with Kick?

To get started with Kick, new users should visit the website and sign up for Early Access. After entering their details, they will receive confirmation that they’ve secured a spot. Once Kick is ready to launch, users will be contacted with further instructions for onboarding. It’s advisable for users to gather relevant financial documents and establish business accounts ahead of time to streamline the process when they begin using the service.

Who is using Kick?

The primary user base of Kick comprises modern business owners, entrepreneurs, and small to medium-sized enterprises looking for efficient and reliable bookkeeping solutions. Users typically come from various industries, including e-commerce, consulting, and creative services, all of whom seek to minimize financial risks and gain real-time insights into their financial standing. The platform appeals particularly to those who prefer to focus on growing their businesses rather than getting bogged down by complex financial tasks.

What key features does Kick have?

Kick offers a range of key features designed to optimize the bookkeeping experience. Users benefit from auto categorization of transactions in real-time, which is reviewed by experts to ensure accuracy and compliance. The platform's AI technology rapidly adapts to changes made by users, enhancing personalization. Receipt matching eliminates the hassle of manually organizing expenses, while user-friendly financial dashboards provide insights into profitability with a reliable Profit & Loss report. Furthermore, users can monitor spending and manage unlimited accounts without extra costs, all contributing to a comprehensive view of their business finances.