Kintsugi

About Kintsugi

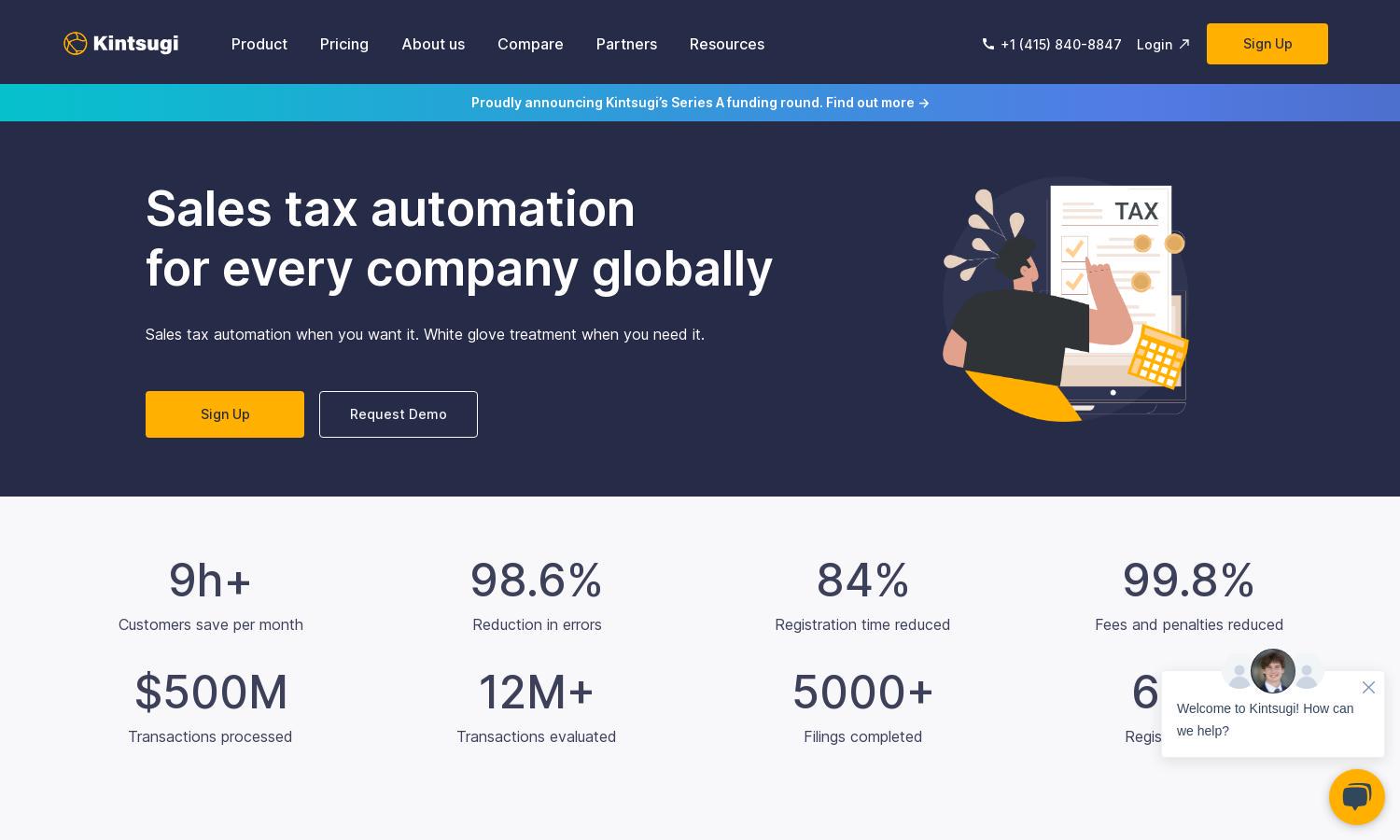

Kintsugi offers an innovative sales tax automation solution designed for businesses seeking compliance with less effort. By simplifying tax registrations, filings, and remittances, Kintsugi allows users to focus on growth while ensuring accuracy and reducing liabilities. Its AI-powered technology optimizes tax management, making it essential for modern businesses.

Pricing plans at Kintsugi are flexible, with a pay-as-you-go model that requires no long-term contracts. The service includes free sign-ups and no upfront fees, allowing businesses to manage sales tax efficiently at their own pace. Upgrading provides enhanced features and comprehensive support tailored to different business needs.

Kintsugi's user interface is designed for simplicity and efficiency, allowing users to navigate through features seamlessly. The platform's clean layout and intuitive design focus on enhancing user experience, making it easy to access crucial information and automate tax-related tasks without a steep learning curve.

How Kintsugi works

Users begin their journey with Kintsugi by signing up and undergoing a thorough onboarding process that includes a detailed audit of their tax exposure. Once registered, they can easily navigate through the platform to connect various billing and payment systems, automate the registration, and track tax liabilities effectively. The user-friendly dashboard offers insights and facilitates timely filings, ensuring compliance and reducing errors in a straightforward manner.

Key Features for Kintsugi

Automated Sales Tax Registration

Kintsugi's automated sales tax registration feature simplifies the process for businesses to register across states. With just a single click, users can ensure compliance and collect the correct tax based on precise, product-specific rules, saving time and reducing the risk of errors.

VDA Management

Kintsugi streamlines Voluntary Disclosure Agreements (VDAs), enabling businesses to manage their back tax liabilities effectively. This feature helps users maintain compliance by identifying tax obligations and automating the VDA process, ensuring they can handle past due amounts confidently without excessive costs.

Error Insurance Coverage

Kintsugi offers error insurance coverage that protects users against mistakes made during sales tax filings. This distinguishing feature assures clients that any errors will be corrected at no extra cost, fostering confidence in the accuracy of their tax compliance efforts.