Kniru

About Kniru

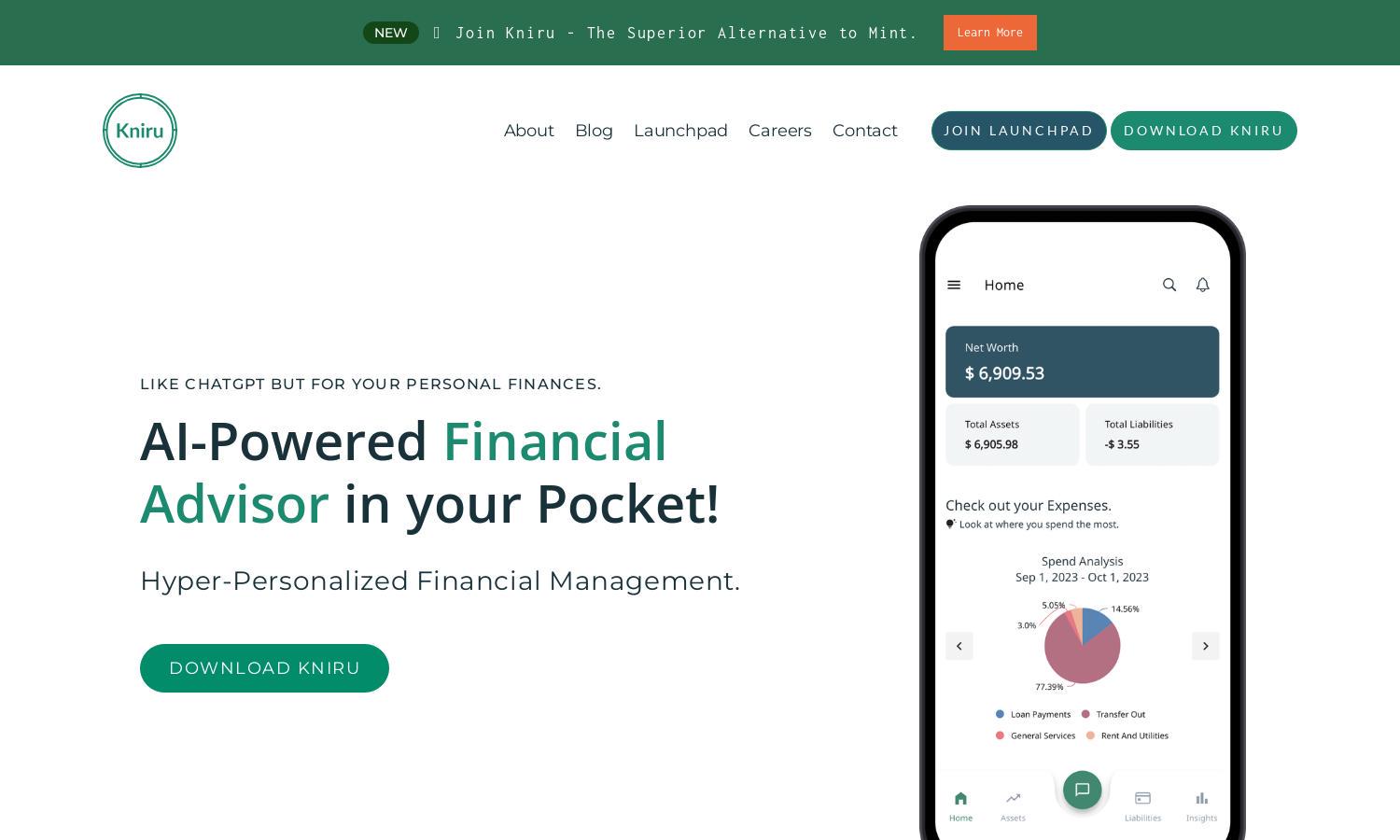

Kniru serves as your AI-Powered Financial Advisor, offering personalized financial guidance through its innovative chat feature. Users can effortlessly access insights on wealth management, retirement, and tax planning. Designed for individuals seeking better financial decisions, Kniru transforms complex data into actionable strategies to enhance financial well-being.

Kniru offers several subscription plans tailored to different user needs. Each tier provides increasing access to premium features like enhanced financial insights, automatic connections to global accounts, and personalized savings suggestions. Upgrading to a higher plan unlocks valuable tools for better financial management, ensuring users receive optimal value from Kniru.

Kniru's user interface is designed for seamless interaction and accessibility, creating an intuitive browsing experience. The layout features visually appealing dashboards for assets, liabilities, and insights, ensuring users can navigate effortlessly. With user-friendly tools and clear functionalities, Kniru offers an exceptional financial management experience tailored to individual needs.

How Kniru works

Users begin their journey with Kniru by creating an account and connecting their financial accounts, including banks and investment platforms. The AI-powered chat feature is ready to assist with tailored advice on various financial matters. Users can ask questions, explore insights, and receive notifications on budgets, expenses, and portfolio performance, ensuring empowered financial decision-making.

Key Features for Kniru

AI-Powered Financial Chat

Kniru's AI-Powered Financial Chat allows users to ask questions and receive immediate, tailored financial advice. This dynamic feature simplifies wealth management, retirement planning, and tax queries, making it an essential tool for users seeking prompt and reliable insight from Kniru.

Hyper-Personalized Insights

Kniru delivers hyper-personalized insights that analyze users' financial situations, offering actionable advice and suggestions. By leveraging data from connected accounts, Kniru ensures users can optimize savings, manage expenses, and navigate investments with confidence and clarity.

Seamless Global Connections

Kniru provides seamless global connections, allowing users with accounts in multiple countries to manage their finances in one place. This feature enhances visibility and accessibility, ensuring users stay informed about their assets and expenses, regardless of their location.

You may also like: