Monarch Money

About Monarch Money

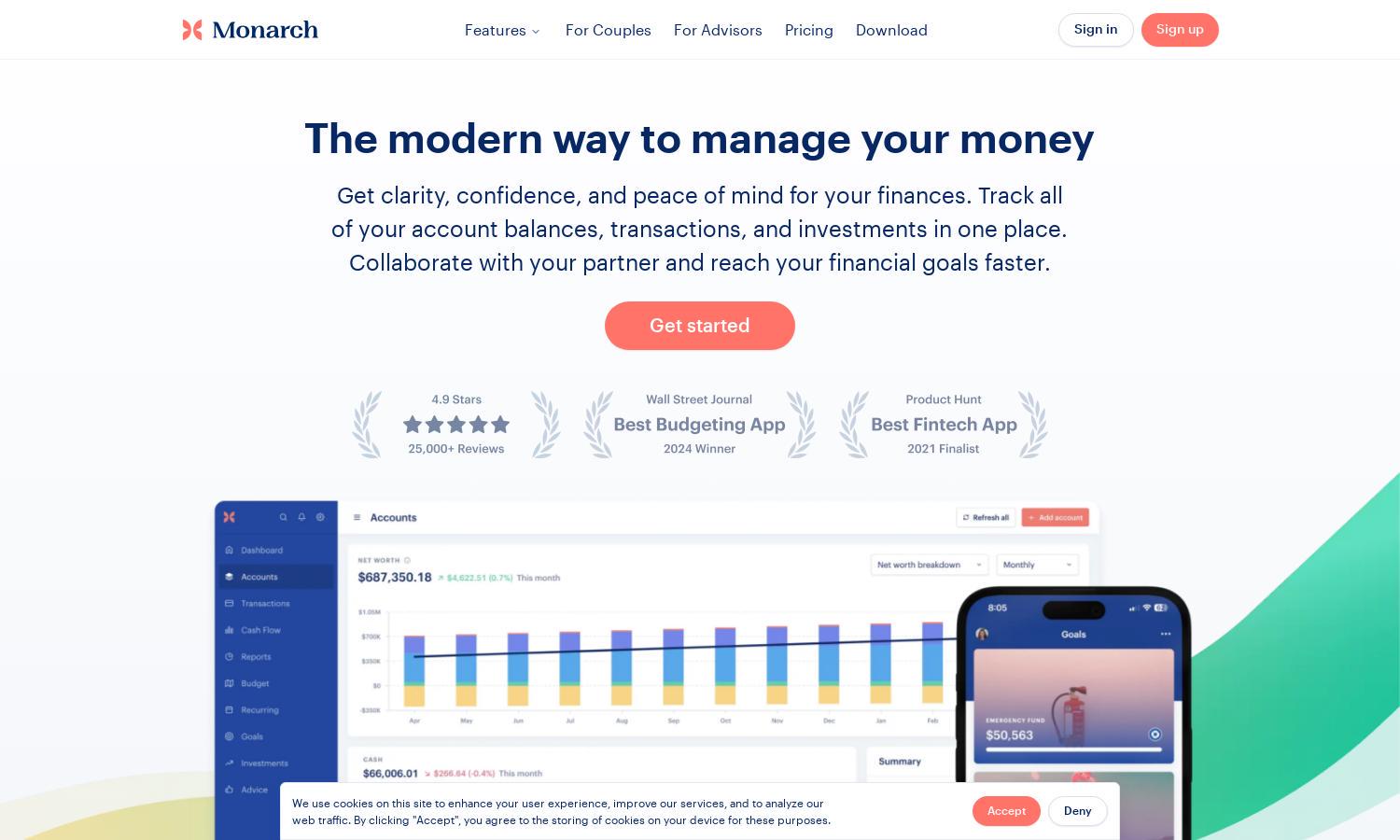

Monarch Money is your all-in-one personal finance platform designed for individuals and families. It enables users to aggregate accounts, monitor spending, analyze investments, and collaborate with partners or financial advisors. With its best-in-class data connectivity and AI-driven features, Monarch Money simplifies financial management and helps achieve financial goals effortlessly.

Monarch Money offers flexible subscription plans to meet various budgeting needs. Users can access essential features across tiers, gaining additional insights and capabilities as they upgrade. New users can enjoy a 30% discount on their first year with the code WELCOME, making it a valuable investment in financial management.

Monarch Money features a sleek and intuitive user interface that enhances the financial tracking experience. With customizable dashboards and reports, users can easily visualize their financial data and progress. This user-friendly design helps ensure that navigating through essential features remains seamless, allowing individuals to focus on achieving their financial objectives.

How Monarch Money works

Users begin their journey with Monarch Money by signing up and securely connecting their financial accounts in a streamlined onboarding process. The platform utilizes AI technology to organize transactions automatically, while users can set custom budgeting categories and track investments in one view. Advanced charts and collaboration tools enhance the overall financial management experience, allowing users to monitor progress towards financial goals effectively.

Key Features for Monarch Money

All-in-One Financial Dashboard

Monarch Money’s all-in-one financial dashboard efficiently aggregates your accounts, transactions, and investments in one view. This innovative feature allows users to easily monitor their overall financial health, ensuring they remain informed and empowered to make better financial decisions tailored to their unique situations.

Collaborative Budgeting Tools

Monarch Money's collaborative budgeting tools enable users to invite partners or advisors to share insights on finances securely. This feature fosters teamwork in achieving financial goals and enhances accountability, allowing couples and families to manage their money together while staying informed and aligned in their financial journey.

Customizable Budgeting Categories

The customizable budgeting categories in Monarch Money allow users to create a personalized budgeting experience. Users can set categories according to their spending habits, ensuring they stay on track and make informed financial decisions tailored to their lifestyle and goals for optimal management of their finances.

You may also like: