Paymefy

About Paymefy

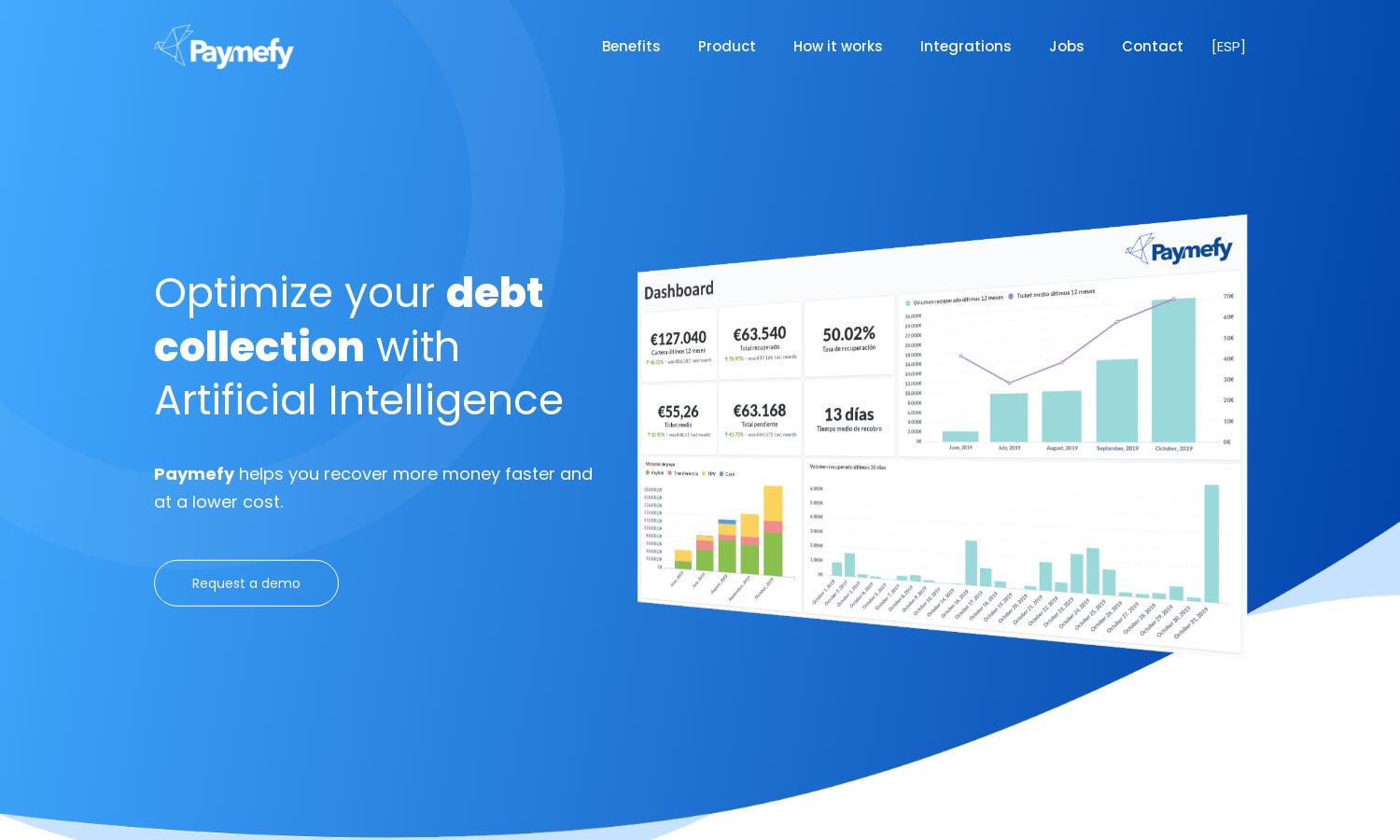

Paymefy is a cutting-edge platform designed to optimize debt collection for businesses. By using Artificial Intelligence, it streamlines the recovery process, enabling faster collections while reducing operational costs. The platform's innovative multichannel notifications and secure payment links provide a seamless experience, ensuring effective communication with customers.

Paymefy offers flexible pricing plans tailored to various business needs. Each tier includes features like automated notifications, secure payment links, and customer insights. Upgrading provides enhanced customization and improved recovery rates, ensuring that users maximize their debt recovery efforts effectively and affordably.

Paymefy boasts a user-friendly interface designed for seamless navigation and ease of use. The layout minimizes clicks and directs users to essential features, such as customizable payment links and automated notifications, enhancing user experience while ensuring effective debt collection processes.

How Paymefy works

Users interact with Paymefy through a straightforward onboarding process that quickly integrates their existing CRM or ERP systems. After setup, businesses can initiate automated debt collection campaigns, customize notifications, and send secure payment links to clients. Paymefy’s multichannel approach ensures consistent communication, leading to faster collections.

Key Features for Paymefy

Automated Payment Links

Paymefy's automated payment links simplify the debt collection process, enabling customers to settle their invoices effortlessly. With just one click, clients can make secured payments, enhancing recovery efficiency and improving user satisfaction, making Paymefy an essential solution for businesses.

Smart Notification Sequences

Paymefy's smart notification sequences leverage multiple channels to remind customers about outstanding payments. This feature enhances the likelihood of timely payments while reducing the need for manual follow-ups, ultimately optimizing the debt recovery process for businesses and increasing overall efficiency.

Multi-Invoice Payment Options

Paymefy offers the unique ability for customers to settle multiple invoices at once. This feature allows clients to manage their debts more conveniently while ensuring businesses can recover funds effectively, enhancing the overall user experience and improving cash flow.

You may also like: