Taxly.ai

About Taxly.ai

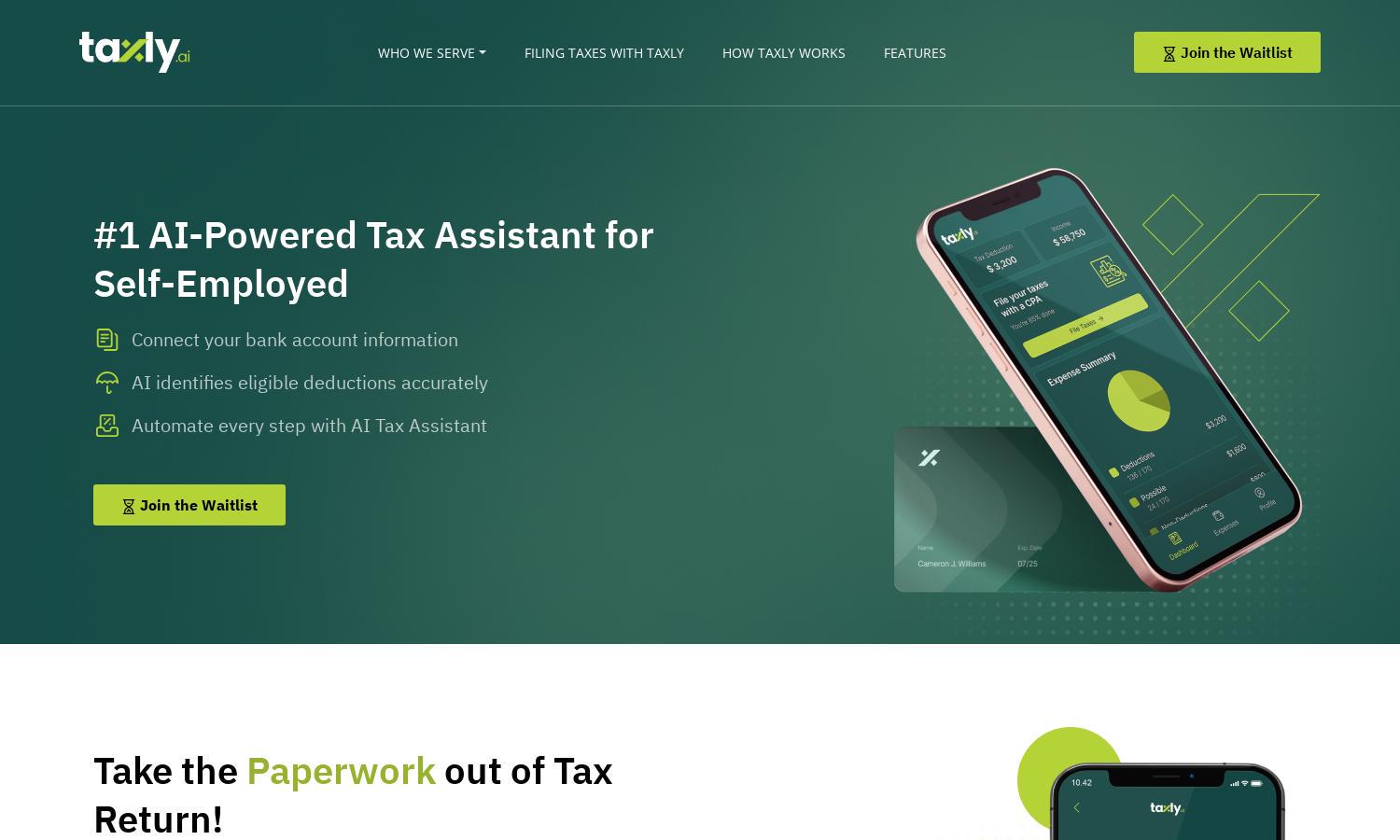

Taxly.ai is an AI-powered tax app designed for freelancers and self-employed professionals. It simplifies tax filing with automated deductions and real-time expense tracking based on ATO guidelines. Users enjoy expert CPA support, ensuring compliance and maximized savings, making Taxly.ai the ultimate solution for efficient tax management.

Taxly.ai offers flexible pricing plans tailored for individuals and self-employed users. Each subscription includes access to AI-powered deductions, CPA support, and real-time tracking. Upgrading unlocks additional features for improved tax management, enabling users to make the most of their tax savings while staying organized and compliant.

Taxly.ai features an intuitive user interface that ensures a seamless browsing experience. The easy-to-navigate design allows users to effortlessly view their tax activities, manage records, and access features. This user-friendly layout enhances overall satisfaction, making tax management straightforward and efficient for freelancers and self-employed individuals.

How Taxly.ai works

Users begin by signing up on Taxly.ai, connecting their transaction records for seamless expense tracking. The AI scans transactions to identify eligible deductions, while the intuitive dashboard offers real-time insights. Users can consult CPA experts for personalized assistance, ensuring they maximize deductions and streamline their tax filing process.

Key Features for Taxly.ai

AI-Powered Tax Deductions

Taxly.ai's AI-powered tax deduction feature revolutionizes individual tax filing. By automatically identifying eligible deductions from transaction data, Taxly.ai helps users save time and maximize their financial return. This innovative approach ensures that no deduction is missed, offering efficient solutions for freelancers and self-employed professionals.

Expert CPA Support

Taxly.ai provides access to expert CPA support tailored for self-employed users. This feature ensures that individuals receive personalized tax advice, compliance assistance, and accurate reporting. By connecting with certified professionals, Taxly.ai users can navigate complex tax scenarios with confidence, making their tax filing experience seamless and reliable.

Real-Time Expense Tracking

Taxly.ai's real-time expense tracking feature allows users to monitor their financial activities effortlessly. By categorizing expenses automatically, this tool helps individuals stay organized and informed about eligible deductions. Utilizing advanced AI technology, Taxly.ai enhances financial management for freelancers and self-employed professionals in Australia.

You may also like: