Avjo

About Avjo

Avjo offers a comprehensive platform for tracking IPO Grey Market Premium (GMP) data, catering to retail investors and institutional buyers. Its real-time updates ensure users stay informed on market trends, enabling better investment decisions through accurate and reliable information on upcoming and past IPOs.

Avjo offers free access to its IPO GMP listing. There are premium subscription tiers available, providing deeper insights and advanced analytics for dedicated investors. Upgrading enhances the user experience with exclusive data, enabling smarter investment strategies based on thorough market understanding.

Avjo features a user-friendly interface, designed for seamless navigation across its IPO GMP listings. The platform's straightforward layout and intuitive design allow users to easily access critical data and insights, ensuring a hassle-free experience and empowering informed investment decisions.

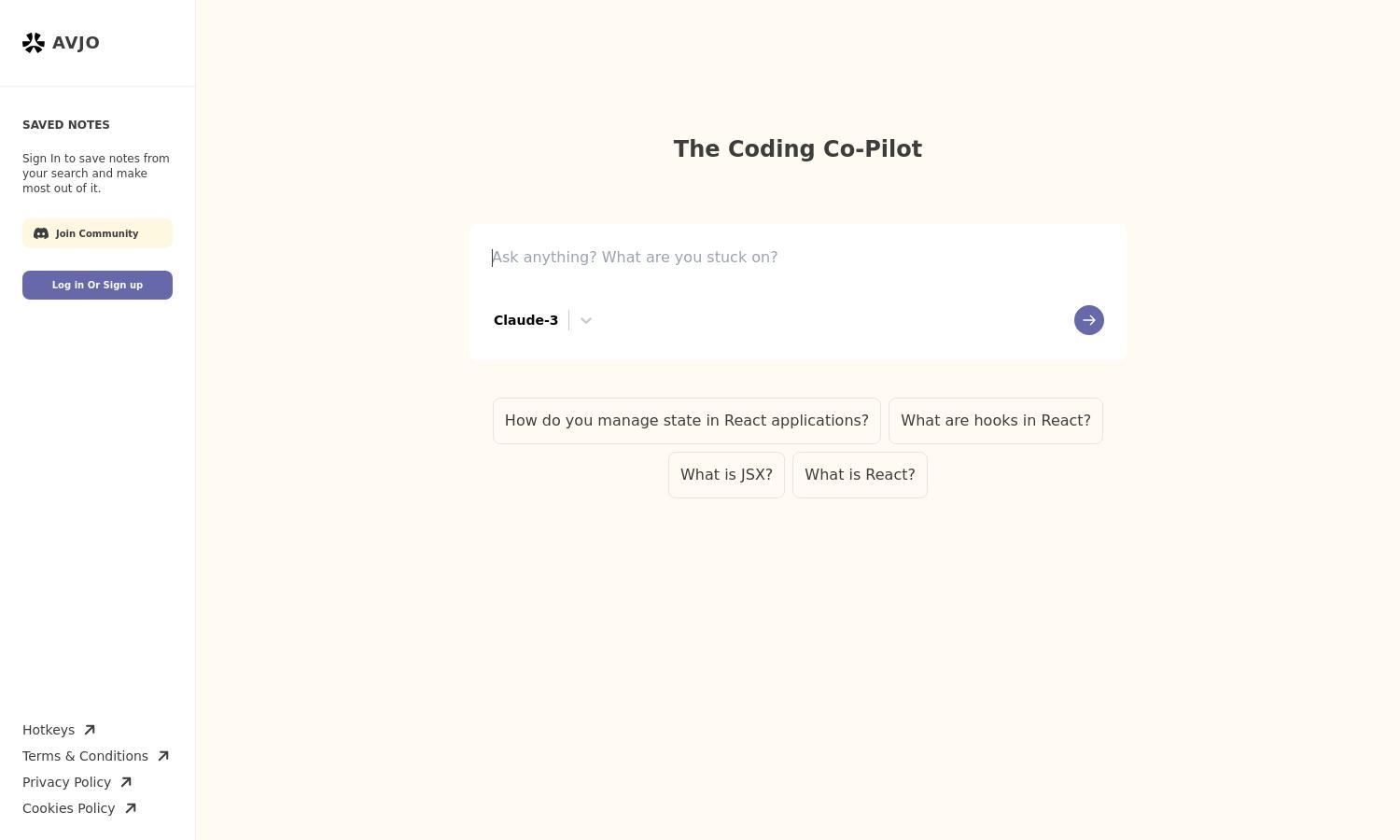

How Avjo works

Users start by visiting Avjo and accessing the IPO GMP list, where they can view real-time data on various stocks. Registration is optional but recommended for personalized features. Users can filter upcoming IPOs, past performances, and various metrics to make informed investment decisions easily, using Avjo’s comprehensive data repository.

Key Features for Avjo

Real-time IPO GMP Data

Avjo's standout feature is its real-time IPO GMP data stream. This unique capability allows investors to access the latest market insights as they happen, ensuring they make informed investment decisions based on current trends and premium fluctuations directly from trusted sources.

Detailed Historical Data

Another significant feature is the platform’s extensive historical IPO data analysis. Users can examine past performance trends, helping them to understand market behaviors and make educated predictions for future IPOs. This depth of data is essential for serious investors relying on trends.

User-Friendly Interface

Avjo boasts a user-friendly interface that enhances the overall experience of navigating IPO data. Its clean and organized layout allows investors, both new and seasoned, to efficiently access the information they need, fostering a smoother and more productive user journey.