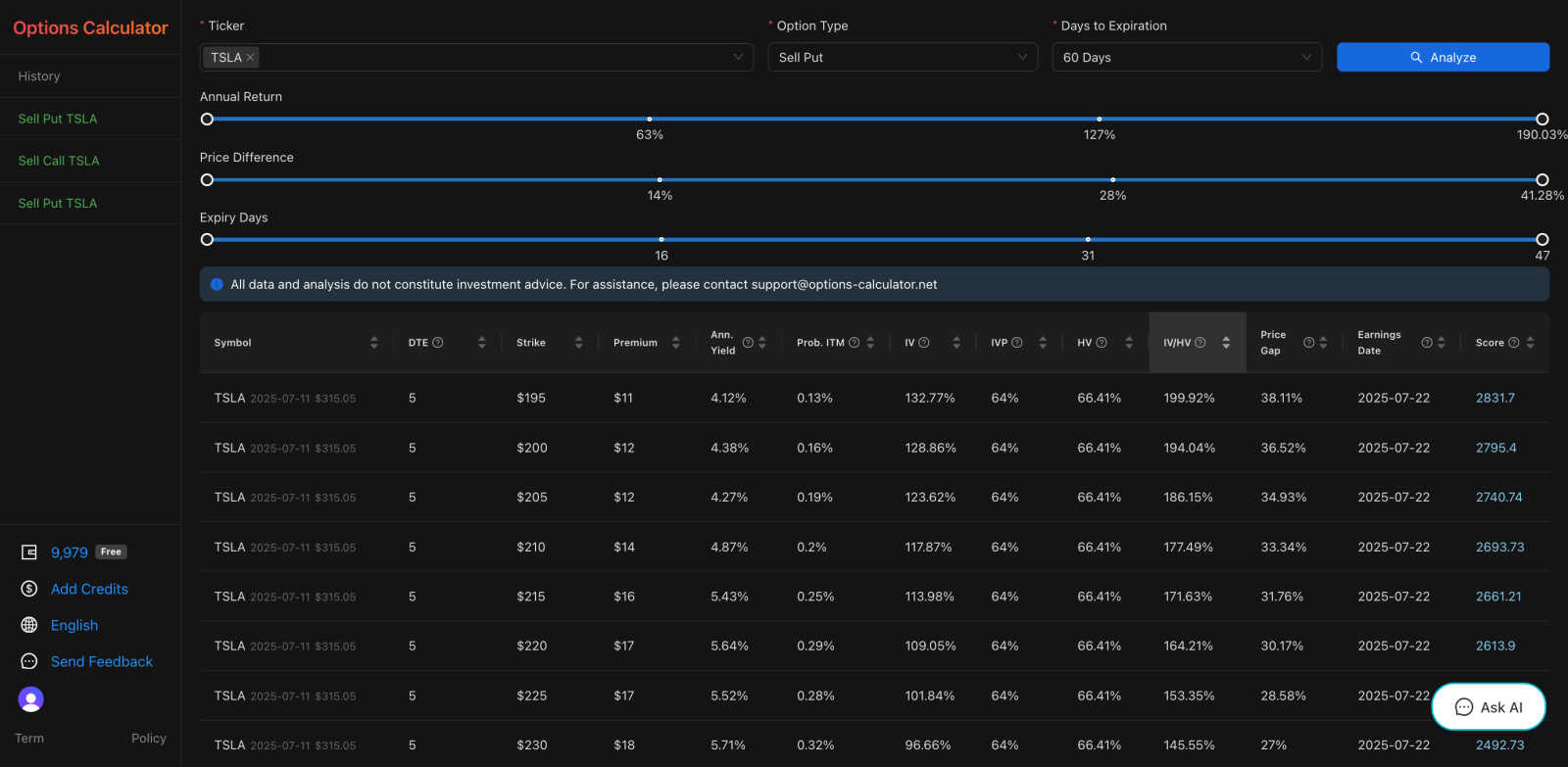

Options Calculator

The smartest AI-powered options calculator. Screen, compare, and strategize your trades with ease.

VisitAbout Options Calculator

Options Calculator is an advanced, AI-powered platform designed to simplify and enhance options trading for both individual traders and professionals. Whether you're new to options or managing complex portfolios, Options Calculator gives you the tools to make smarter, faster, and more informed decisions.

Key Features

1. AI-Powered Options Screening Ask natural-language questions like “Which put options have the highest return next week?” or “What are the best plays for high implied volatility?” Our intelligent engine understands your queries and delivers actionable, ranked option opportunities instantly. No more manual filtering — just precise results tailored to your goals.

2. Cross-Symbol and Cross-Expiration Comparison Compare multiple option contracts across different stocks, strikes, and expirations. View side-by-side analyses of return profiles, Greeks, implied volatility, historical volatility, and probability of exercise. Identify the most favorable setups in seconds, not hours.

3. AI Strategy Builder Input your market outlook — bullish, bearish, neutral, or high-volatility — and let the AI generate complete options strategies for you. From covered calls and credit spreads to iron condors and calendar spreads, every strategy comes with detailed risk-reward breakdowns and expected performance insights.

4. Quantitative Scoring and Evaluation Each option contract and strategy is automatically scored based on key metrics: time decay advantage, volatility edge, Delta-neut

Key Features

1. AI-Powered Options Screening Ask natural-language questions like “Which put options have the highest return next week?” or “What are the best plays for high implied volatility?” Our intelligent engine understands your queries and delivers actionable, ranked option opportunities instantly. No more manual filtering — just precise results tailored to your goals.

2. Cross-Symbol and Cross-Expiration Comparison Compare multiple option contracts across different stocks, strikes, and expirations. View side-by-side analyses of return profiles, Greeks, implied volatility, historical volatility, and probability of exercise. Identify the most favorable setups in seconds, not hours.

3. AI Strategy Builder Input your market outlook — bullish, bearish, neutral, or high-volatility — and let the AI generate complete options strategies for you. From covered calls and credit spreads to iron condors and calendar spreads, every strategy comes with detailed risk-reward breakdowns and expected performance insights.

4. Quantitative Scoring and Evaluation Each option contract and strategy is automatically scored based on key metrics: time decay advantage, volatility edge, Delta-neut

You may also like:

Wan2.2 AI Video Generator

Create cinematic AI videos in seconds — powered by Wan 2.2 video generator

Wan2.2 Video generation

Create cinematic AI videos with Wan2.2 – the open-source MoE video generation model. Convert text or images into 720P videos with fine-tuned motion an

Best Name Generator

Create unique and meaningful names instantly with our free AI tool. Unlimited uses, no signup required. Generate