Peslac

About Peslac

Peslac is a premier insurance technology provider focused on transforming the insurance sector in Africa. Targeting insurance companies, startups, and fintechs, it offers cutting-edge solutions like the API-first InsurSphere for seamless integration, along with automated claims processing and enhanced fraud detection capabilities.

Peslac offers flexible pricing plans tailored for various business sizes and needs. Each tier provides unique capabilities, including advanced automation and real-time analytics. Upgrading unlocks additional features for improved operational efficiency and enhanced customer experience, making Peslac the ideal choice for modern insurance providers.

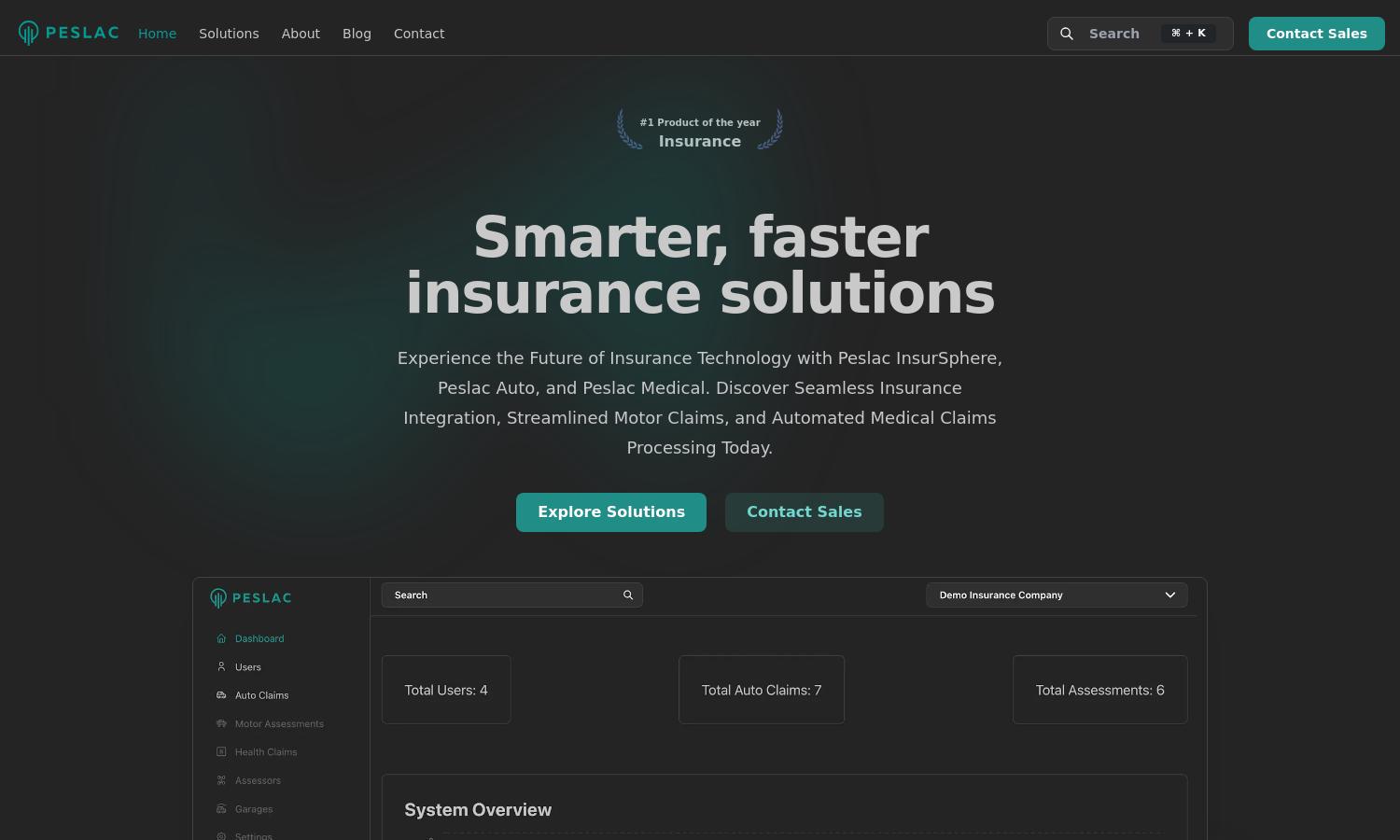

Peslac’s user interface is designed for optimal usability, featuring intuitive navigation and clear layout. Users enjoy a seamless browsing experience, with easy access to essential features like claims management and data analytics. This user-friendly design aligns with Peslac’s commitment to enhancing customer satisfaction across insurance processes.

How Peslac works

Users begin their journey with Peslac by signing up and undergoing a quick onboarding process. From there, they can easily navigate the platform’s user-friendly interface to access various insurance solutions. Key features like automated claims processing and real-time analytics allow users to streamline workflows effectively, improving overall operational efficiency.

Key Features for Peslac

API-First Insurance Distribution

Peslac's API-first distribution solution, InsurSphere, revolutionizes how businesses integrate insurance offerings. This unique feature allows companies to seamlessly embed insurance into their platforms, enhancing user experience and driving new revenue streams while streamlining the insurance process for customers and providers alike.

Automated Claims Processing

Peslac's automated claims processing feature significantly improves operational efficiency for insurers. By leveraging advanced machine learning algorithms, this function detects fraud and expedites claim settlements, ensuring that insurance providers can deliver faster and more reliable service to their customers, enhancing overall satisfaction.

Real-Time Analytics

Real-time analytics is a standout feature of Peslac, providing insurers with valuable insights into operations and customer behavior. This function enables data-driven decision-making, allowing businesses to optimize their processes, identify trends, and enhance fraud detection, ultimately improving performance and driving growth.

You may also like: