WorkFusion

About WorkFusion

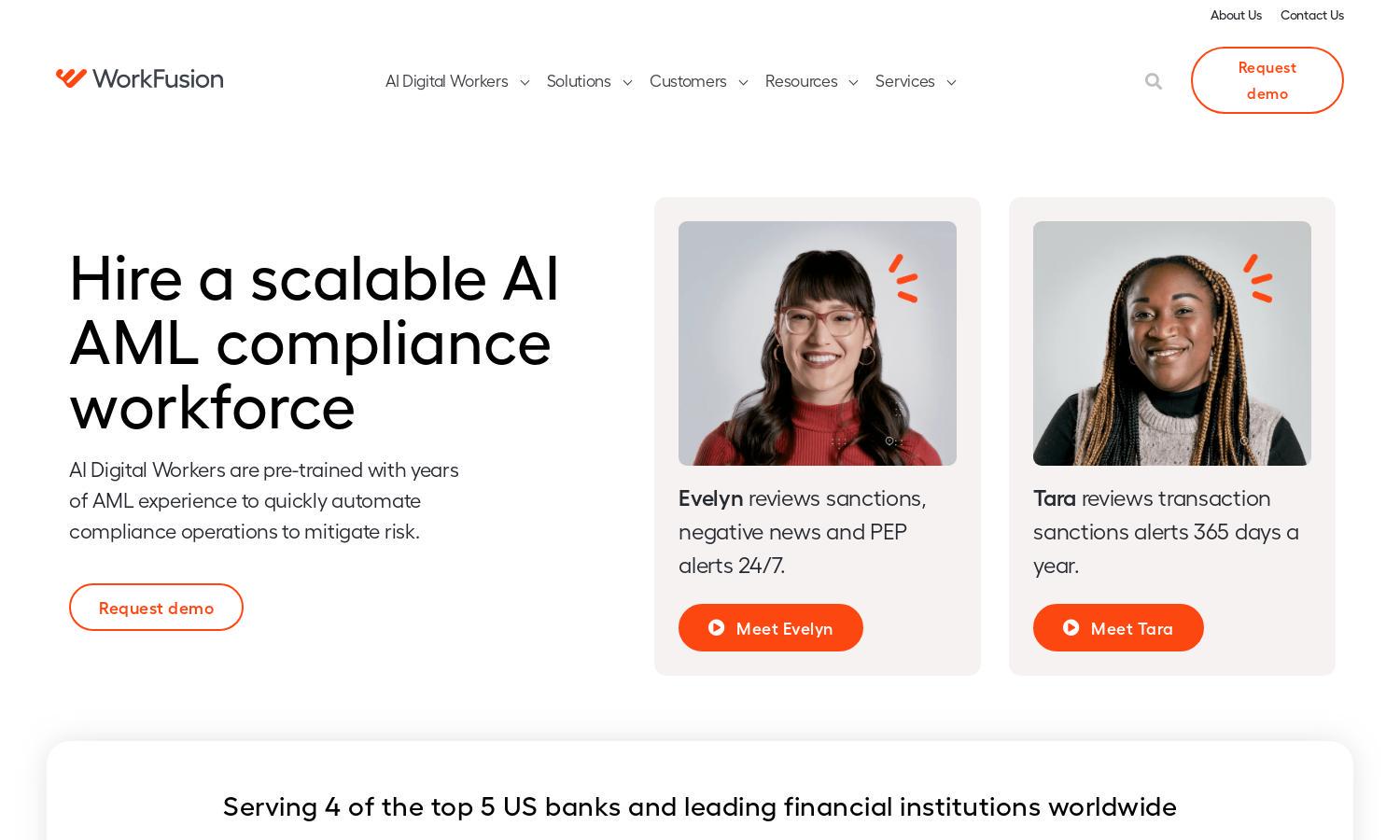

WorkFusion leverages AI Digital Workers to transform AML compliance processes, from managing alerts to conducting KYC operations. Targeted at financial institutions, the platform enhances operational efficiency while reducing costs and manual effort. Users benefit from quick onboarding and scalable solutions tailored to compliance needs.

WorkFusion offers flexible pricing based on user requirements, which can include subscription tiers designed for different organizational needs. Upgrading provides enhanced capabilities and efficiencies in AML processes, ensuring compliance and cost reduction. Discounts may be available for large-scale operations, making it a cost-effective choice.

The user interface of WorkFusion is designed to facilitate seamless navigation across its features, providing a streamlined experience. Intuitive layouts and easy access to tools enable users to manage AML compliance tasks effectively, ensuring high usability and satisfaction while maximizing the benefits of the platform.

How WorkFusion works

Users start by onboarding onto WorkFusion, where they'll receive training tailored to their specific compliance needs. Once onboarded, they can navigate the dashboard to access various functions, including alert reviews and investigations. The platform's AI effectively automates processes, significantly reducing manual labor while providing key insights into compliance operations.

Key Features for WorkFusion

AI Digital Workers

WorkFusion's AI Digital Workers are pioneering tools designed to automate AML compliance tasks. These agents operate around the clock, efficiently handling alert reviews and investigations, thus minimizing the need for extensive human oversight and ensuring high-quality compliance outputs under demanding conditions.

Real-Time Alert Adjudication

The real-time alert adjudication feature of WorkFusion enhances the speed and accuracy of compliance checks. By automating false-positive resolution, organizations can react quickly to potential risks, thereby ensuring steady compliance with regulatory standards while improving overall efficiency and reducing operational costs.

Enhanced KYC Processing

WorkFusion's enhanced KYC processing feature streamlines customer onboarding, reducing manual labor while mitigating risks. This innovation accelerates compliance with regulations, ensuring that clients receive prompt service and organizations can maintain high standards for customer verification and due diligence.

You may also like: