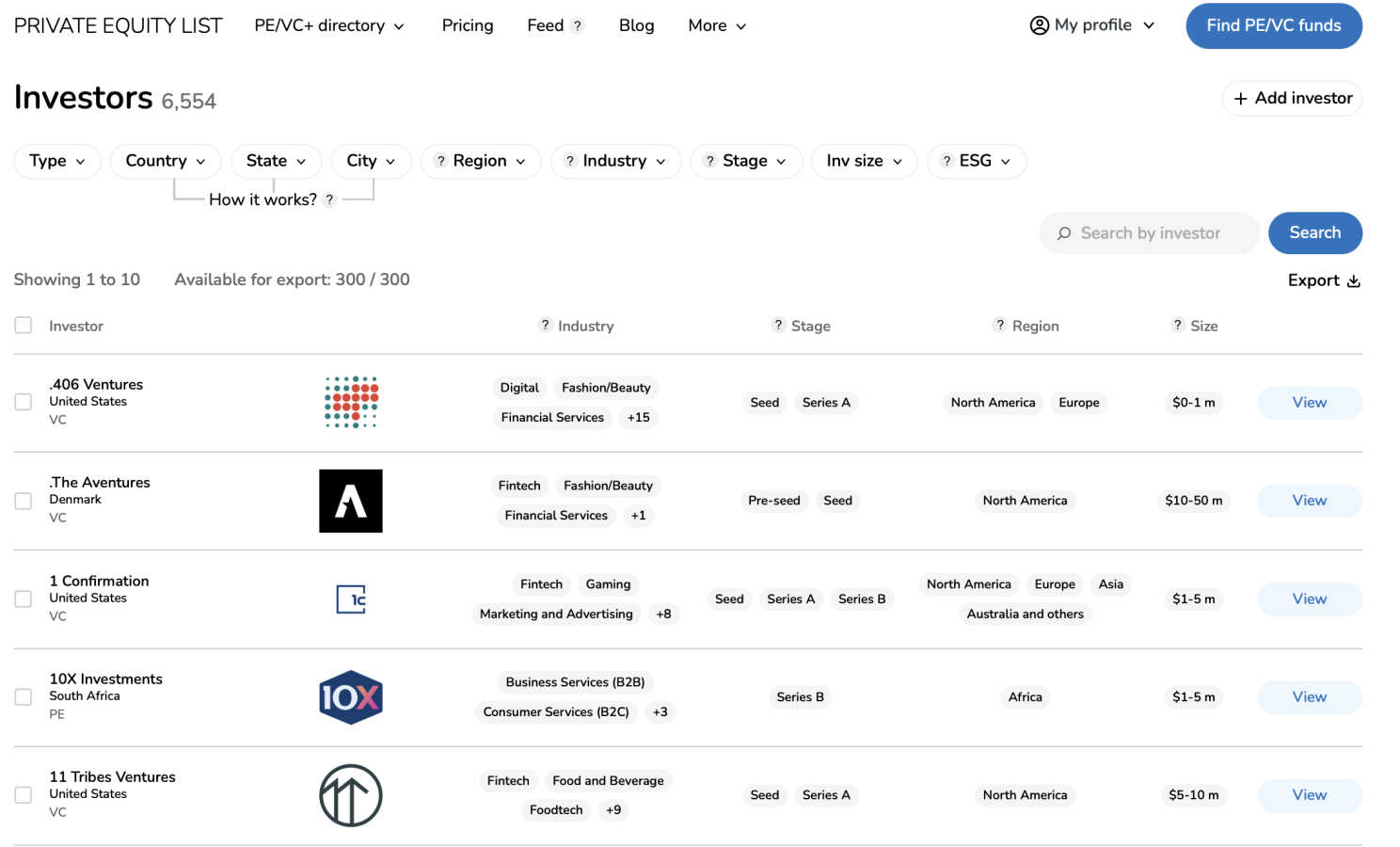

Private Equity List

Effortlessly connect with investors using our AI-powered database for private equity and venture capital funding.

Visit

About Private Equity List

Private Equity List is an innovative AI-powered database tailored specifically for connecting users with the right private equity and venture capital investors. Designed to simplify the fundraising process and partnership research, this platform stands out by cutting through the typical noise found in generalist databases. It's your cost-effective assistant for all things related to funding, whether you are a startup founder seeking seed financing, a consultant creating client lists, or a researcher delving into market trends. With the addition of an AI search function, users can now find targeted investor data more efficiently. The platform is built to provide structured and up-to-date insights, making it easier for users to access accurate and actionable investor intelligence. With over 10,700 users, Private Equity List offers powerful search tools, enriched contact details, and export-ready lists, all at a fraction of the cost compared to enterprise alternatives. This makes it the go-to choice for those needing reliable PE/VC data without the complexity or high price tag of other solutions.

Features of Private Equity List

AI-Powered Search Function

The newly added AI search function allows users to find specific investor data quickly and efficiently. This feature helps streamline the search process, making it easier to connect with potential funding sources based on tailored criteria.

Targeted PE/VC Investor Lists

Private Equity List offers curated lists of private equity and venture capital investors, focusing on specific geographies, investment stages, and thesis areas. This targeted approach ensures users can find the most relevant investors for their needs without sifting through irrelevant data.

Enriched Contact Details

Users gain access to comprehensive and enriched contact information for investment teams, which includes roles and direct contact details. This feature facilitates direct outreach, enhancing the chances of successful connections with potential investors.

Export-Ready Lists

The platform provides users with the ability to create and export lists in bulk, enabling easy sharing and further analysis. This functionality is especially useful for consultants and advisors who need to present tailored lists to clients efficiently.

Use Cases of Private Equity List

Startups Looking for Funding

Startups can utilize Private Equity List to identify and connect with potential investors quickly. By filtering options based on geography, ticket size, and investment stage, they can efficiently find the right match for their funding needs.

Consultants Creating Shortlists

Consultants can leverage the database to create tailored investor shortlists for their clients. This helps them close fundraising and M&A mandates more quickly, thus enhancing their service offerings and client satisfaction.

VC Ecosystem Networking

Venture capital firms, accelerators, and venture studios can use the platform to discover co-investors and strategic partners. This collaboration can strengthen their portfolio companies' future funding rounds and overall growth strategies.

Research and Market Analysis

Researchers, universities, and journalists can tap into the extensive data provided by Private Equity List to analyze market trends, report on funding landscapes, and gain insights into investor behaviors and preferences.

Frequently Asked Questions

What types of investors can I find on Private Equity List?

Private Equity List provides access to a diverse range of investors, including private equity firms, venture capitalists, and accelerators, covering multiple stages of funding and various geographic locations.

Can I try Private Equity List for free?

Yes, Private Equity List offers basic functions free of charge, allowing users to explore the platform without the need for a credit card or any upfront payment.

How accurate is the data provided by the platform?

While the platform utilizes AI to enhance search capabilities, users are encouraged to verify the accuracy of the data as AI systems can occasionally make mistakes.

How often is the data updated on Private Equity List?

The database is updated nearly daily, ensuring that users have access to the most current and relevant information regarding private equity and venture capital investors.

Explore more in this category:

Top Alternatives to Private Equity List

GoldPal

Track your gold portfolio with real-time prices and AI-powered market intelligence.

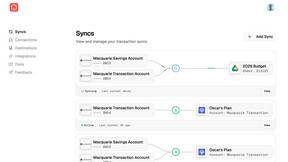

Fusedash

Fusedash turns your raw data into clear dashboards and charts so your team can act on insights instantly.

Redbark

Sync your Australian bank and brokerage data automatically to apps like Google Sheets and YNAB.

SoloTools

SoloTools uses AI to create polished client proposals in seconds, streamlining your project scope, pricing, and.

QuoteCraft AI

QuoteCraft AI creates winning proposals for freelancers in seconds, ensuring clear scope and competitive pricing.

My Agentic SEO

My Agentic SEO connects to Google Search Console to identify content gaps and write optimized articles in your voice.